PHILIPPINES – Concern about the impact of the COVID-19 pandemic among insurance customers runs deeper in the Philippines than in most of Asia, prompting many Filipinos to adopt new habits around a healthier lifestyle and greater use of digital technology, according to a new survey by Manulife.

The Manulife Asia Care Survey, conducted in late May, targeted 300 insurance owners in the Philippines. Most respondents expressed concern about the pandemic’s long-term impact on the local economy and their day-to-day living. The pessimism of Filipinos about the likelihood of COVID-19 slowing down in the next six months was second to that of Indonesians, among those across the eight markets surveyed. More than half (58%) of the Filipino respondents said they thought COVID-19 would get more serious during the second half of 2020, above the regional average of 41%.

Greater use of digital technology during the pandemic is also evident among those surveyed across the region, yet in the Philippines it was more pronounced. Along with the increased interest in digital was a move towards more regular management of personal finance. And an extension of this is that Filipinos have a growing appetite for insurance.

Filipinos adopt healthier lifestyles and digital services

Nearly all of the Philippines-based respondents, who are all insurance policyholders, have adopted new lifestyle habits under the COVID-19 pandemic (98%). Majority of these new habits are geared towards healthier living and increased reliance on e-commerce, online and digital services.

In the Philippines, 64% of the respondents found ways to be more physically healthy than before COVID-19, the highest percentage than all of the other markets surveyed. Yet, in terms of tracking their mental health status, only 27% had adopted this new habit since the outbreak started in the Philippines. Despite that, health consciousness is on the rise and lifestyle habits are undoubtedly becoming healthier in both body and mind. Of the respondents, 33% said they have already started to monitor their health KPIs closely. During the next 18 months this is set to grow, with 52% looking to find ways to be more physically healthy, 20% tracking their mental health and 25% watching their health indicators, such as blood pressure and blood sugar level, more closely.

“We support Filipinos in their heightened desire to make better lifestyle choices every day, whether on their health or finances,” said Melissa Henson, Senior Vice President and Chief Marketing Officer, Manulife Philippines. “Through this study, we are able to identify their concerns, priorities, and goals so we can provide the necessary solutions to help address our customers’ financial and health needs and help them live every day better.”

This appetite for a healthier and more active lifestyle is important, given the rising cost of healthcare and the need for local health services to meet increased demand from a growing middle class and longer life expectancy.

In the Philippines and across Asia, healthcare costs have increased significantly over the past 20 years, rising nearly 500% during that period, according to the World Bank. In 2017, the annual healthcare cost per capita in the Philippines was USD133, or 4.45% of GDP.

Greater focus on personal finance and insurance

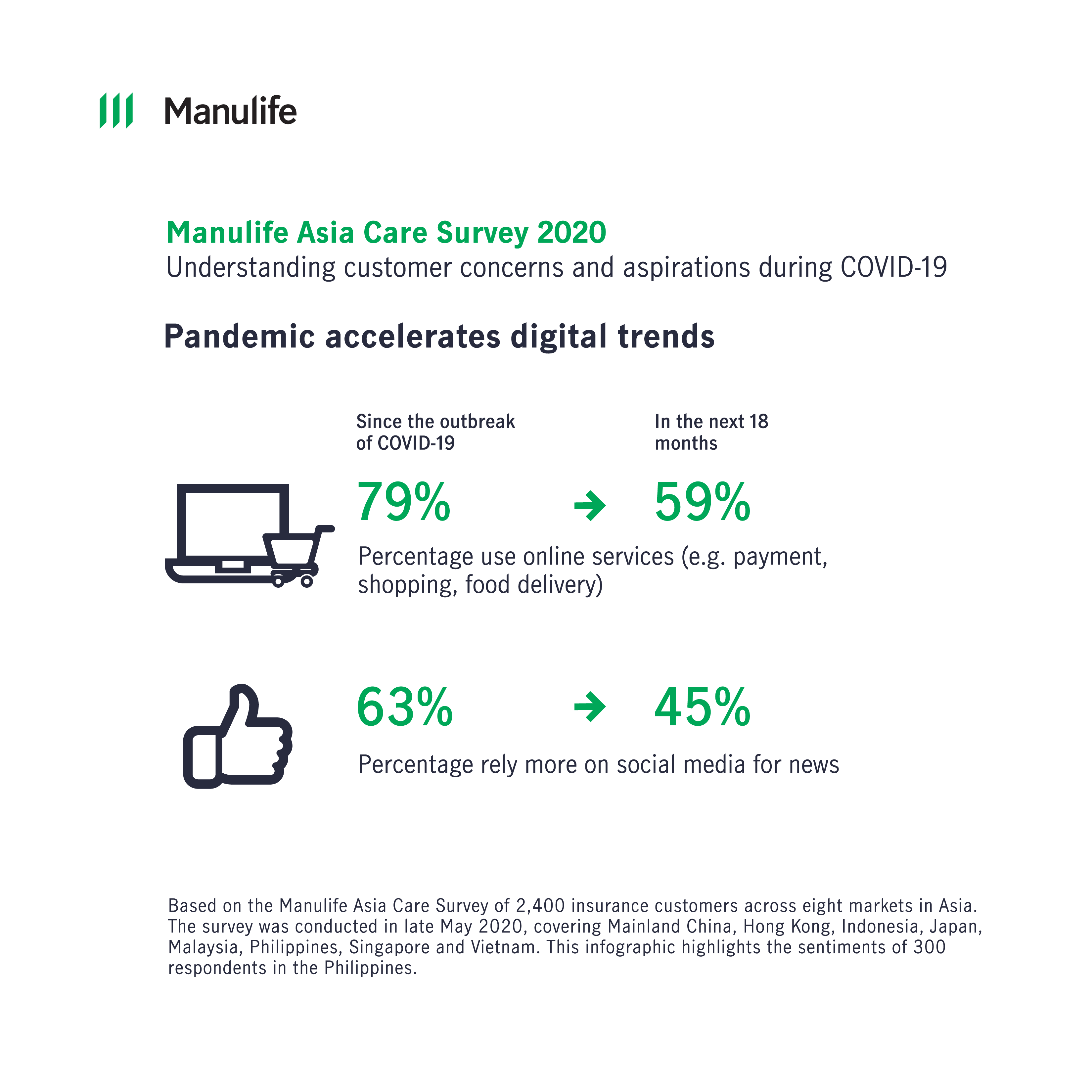

Along with their desire to get fitter, 46% of respondents in the Philippines said the pandemic had caused them to review and manage personal finance more often than before COVID-19. Much of this is likely done online. The survey showed greater willingness to switch to using online services, such as online chats and online payment (79%) and using online tools for news and socialization (both 63%) since the start of the pandemic. Switching shopping from offline to online is quite substantial (46% of the respondents have done so) since COVID-19 started.

COVID-19 has accelerated trends already in place, notably digitization in lifestyle. The acceptance and adoption of these trends provide another reason to believe that the changing habits will, in part at least, be permanent. In the Philippines, digitization and use of smartphones is enabling greater numbers of Filipinos to get access to financial services and other online tools. COVID-19 has helped to reinforce the value of digital tools and services.

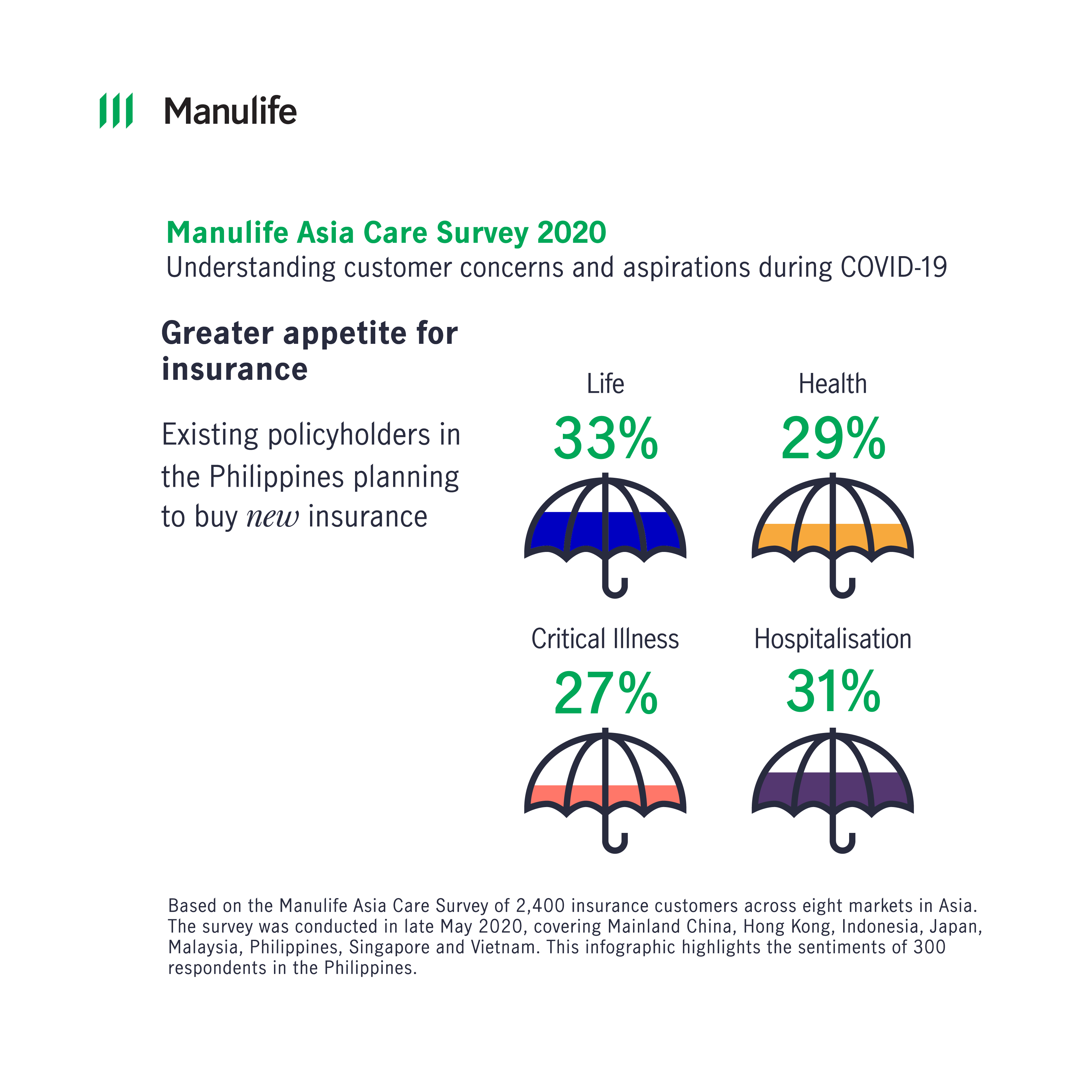

The Philippines is one of the region’s most under-insured countries. One measure of insurance penetration is gross written premiums as a percentage of per-capita GDP. In the Philippines, along with a few other markets in the region, penetration rate is less than 1%, far below the rates in markets such as Hong Kong and Singapore.

As such, it is interesting that 77% of those surveyed in the Philippines intend to buy new additional insurance in the next 18 months, which is the most robust level among all the markets surveyed and well above the regional average of 62%. Life (33%), health (29%) and hospitalization (31%), accident (28%) and critical illness (27%) are the main new insurance products being considered by insurance owners in the Philippines.

“In the Philippines, we see people increasingly recognize the risks around critical illness. As well, there’s a consciousness about the likelihood of unforeseen accidents. Besides being health issues, these are extremely stressful for the patient and his or her family, not least because the rising cost of healthcare and hospitalization can be a tremendous financial burden,” Henson added. “More and more, with the use of digital tools now available, we see people seeking out the best protection option for their needs.”

In terms for general health and well-being, a willingness to manage insurance via digital channels combined with new-found – or reawakened – interest in being more active means that the respondents in the Philippines can tap into insurer products that help to make an active lifestyle more rewarding in terms of being fun and engaging.