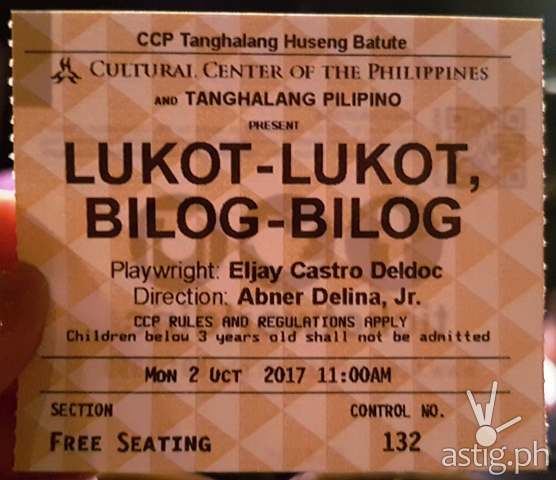

Teaching about the importance of financial literacy to today’s youth is not that easy, especially if you don’t start them young. This is one of the reasons why Visa launched an interactive play recently in partnership with Tanghalang Pilipino (TP) and Bangko Sentral ng Pilipinas (BSP) entitled – Lukot-lukot, Bilog-bilog (Crumpled, Round). It aims to provide the youth important facts on saving their money, making wise financial decisions and arm them with the knowledge of investing for their future. This is the first program of its kind launched by Visa in the Philippines in support of the government’s National Strategy for Financial Inclusion spearheaded by the Bangko Sentral ng Pilipinas.

Lukot-lukot, Bilog-bilog will showcase common scenarios faced by a Filipina senior high school student protagonist named Gwyneth who is challenged to make decisions between her needs and wants. Native Filipino heroes such as Jose Rizal and Apolinario Mabini will also ‘come alive’ from the crumpled bills and rounded coins to help the main character make wise decisions.

The launch also included a panel discussion on the importance of financial literacy in the Philippines, including panelists such as Dan Wolbert, Visa Philippines Head of Sales, Pia Roman-Tayug, Bangko Sentral ng Pilipinas Head of Inclusive Finance Advocacy, Nanding Josef, Tanghalang Pilipino Artistic Director, and Patricia Feria-Lim, Teach for the Philippines Chief Strategy Officer.

“At Visa, we strongly believe in the importance of financial literacy and it is a key area of focus as part of our corporate social responsibility efforts. Hence, with the support of BSP, we created this financial literacy program and interactive play through Lukot-lukot, Bilog-bilog where the Filipino youth can relate to various scenarios on making money management decisions. With millennials forming a large population in the Philippines, we believe it is crucial to spread the knowledge of how to manage their money at a young age and to highlight the importance of making smart monetary decisions,” said Stuart Tomlinson, Visa Country Manager for the Philippines and Guam.

Starting October, the show will be performed in close to 10 different schools to make financial literacy education more accessible to the students. This program is aligned with the government’s National Strategy for Financial Inclusion, in particular, the pillar of financial education and consumer protection.

“We believe that financial education should be introduced to learners early on, especially key concepts including budgeting, investing, and setting financial goals. An innovative approach such as blending education and art are most welcome and can help the existing programs of the government. This is a tangible support from the private sector of the objectives of the NSFI, particularly the pillars of financial education and consumer protection,” says Pia.

“The informative and interactive performances will stimulate creativity and challenge its audience on their perception of money,” says Nanding Josef, Tanghalang Pilipino Artistic Director. With the creative direction of TP, the play will spark critical thinking in these youths on the value of money. “By presenting economic concepts in realistic and entertaining situations, we hope that audiences will find it easier to apply their learnings in their daily lives,” added Nanding.

Visa’s financial literacy initiative also aims to reach out to students under Teach for the Philippines, a program Visa has been actively involved with previously.

“Experiential learning has been proven to be an effective method for encouraging mastery and understanding. At Teach for the Philippines, we believe that programs which incorporate financial literacy and theater arts in academics develop the critical life skills of our learners. We look forward to a continued partnership with Visa Philippines, BSP, and Tanghalang Pilipino to bring our learners closer to their full potential and enable them to contribute meaningfully to nation-building,” said Patricia.

“We want to secure the future of the Filipino youth and are committed to forging the path to financial literacy and inclusion. We envision the program to reach more students throughout the country in the coming years,” added Stu.

About Visa

Visa Inc. (NYSE: V) is the world’s leader in digital payments. Our mission is to connect the world through the most innovative, reliable and secure payment network – enabling individuals, businesses and economies to thrive. Our advanced global processing network, VisaNet, provides secure and reliable payments around the world and is capable of handling more than 65,000 transaction messages a second. The company’s relentless focus on innovation is a catalyst for the rapid growth of connected commerce on any device, and a driving force behind the dream of a cashless future for everyone, everywhere. As the world moves from analog to digital, Visa is applying our brand, products, people, network and scale to reshape the future of commerce. For more information, visit www.visa.com.ph, http://visaapnews.asia/, and @VisaNews